Best Cryptocurrency Exchanges and Apps of 2026

The cryptocurrency market is constantly evolving, and with it, the number of platforms and apps for buying, selling, and trading cryptocurrency. With so many options available, it can be difficult to choose the best cryptocurrency exchanges.

In this article, we provide you some of the most reputable and trustworthy options.

Table of content

The Best Cryptocurrency Exchanges

To find the best cryptocurrency exchanges, we researched platforms' security, offerings, availability, fees, financial options, features, and mobile capabilities.

Crypto.com

Crypto.com is one of the best cryptocurrency exchanges with a user-friendly platform for buying, selling, and trading over 250 cryptocurrencies. It is also is one of the fastest-growing crypto exchanges, with over 10 million users in over 100 countries.

Fees: Variable fees (Crypto.com), 0.14%-0.40% (Crypto.com Pro)

Pros

- Large selection of cryptocurrencies

- Competitive fees

- User-friendly platform

- Wide range of products and services

Cons

- Complex platform for beginners

- Not available in all countries

- Customer support can be slow

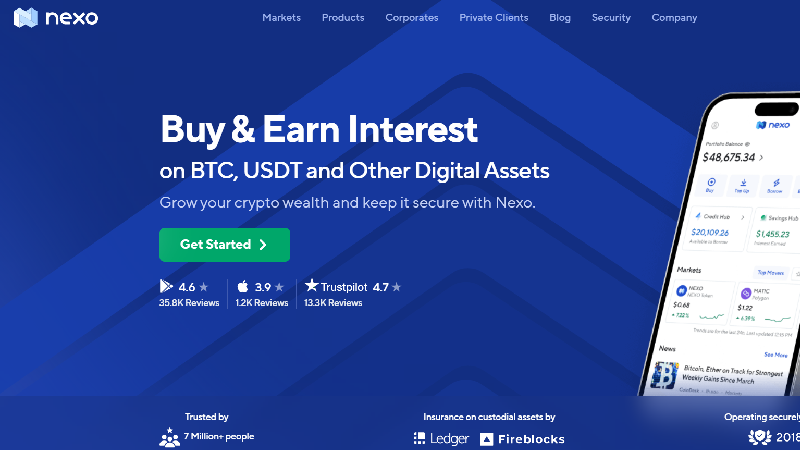

Nexo

Nexo is a user-friendly platform where you can buy, swap, and hold Bitcoin and a wide variety of other cryptocurrencies. With access to over 500 trading pairs, you can trade more than 70 digital currencies without any fees. The platform also offers easy-to-use trading features like Swap, Trigger Swap, and Booster.

Fees: between 0.00% and 0.15%

Pros

- Strong security measures

- Wide range of financial products

- Innovative financial tools

- Attractive interest rates

- Multilingual customer support

- Very low fees

Cons

- Regulatory challenges

- Market risks

- Limited access

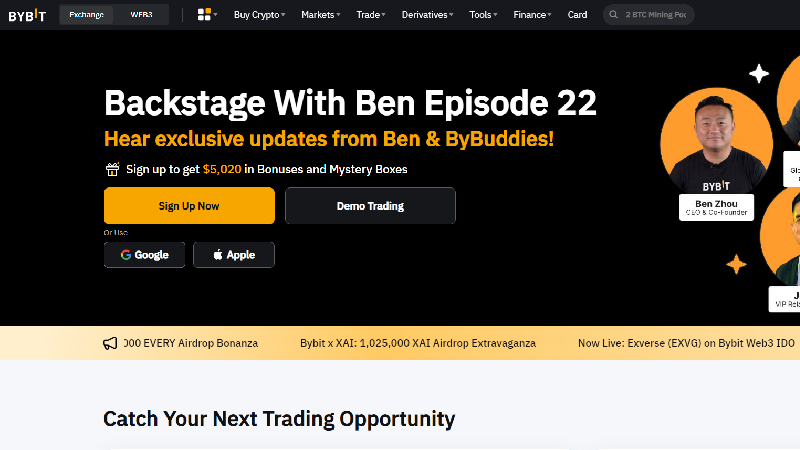

Bybit

Bybit is known for its user-friendly interface and extensive trading options. It allows free conversion between 4 cryptocurrencies and 62 fiat currencies, including USD. Getting started is easy with a quick sign-up and KYC process. The platform makes it simple to post ads for buying or selling crypto and complete transactions quickly.

Fees: No fees charged

Pros

- Offers zero transaction fees for both the buyer and seller

- Fast transactions, with a maximum confirmation time of 15 minutes

- Supports a wide variety of currencies

Cons

- Regulatory challenges

- Limited access

- Difficult interface for new users

Bitfinex

Bitfinex is recognized as a professional trading platform capable of managing a high volume of trades simultaneously. It provides various trading options, including direct currency swaps, margin trading, lending, and futures trading.

The exchange also holds a large amount of Bitcoin, with around 400,000 BTC in its digital wallet, making it the second-largest in the world.

Fees: Variable fees (start at 0.20% for trades of $0.00 or more)

Pros

- Competitive trading fees

- Comprehensive education center with diverse content

- Solid security practices

- Advanced trading features

- Email and chat support available

Cons

- No insurance fund for assets on the platform

- Doesn’t offer a crypto credit card

- No phone support

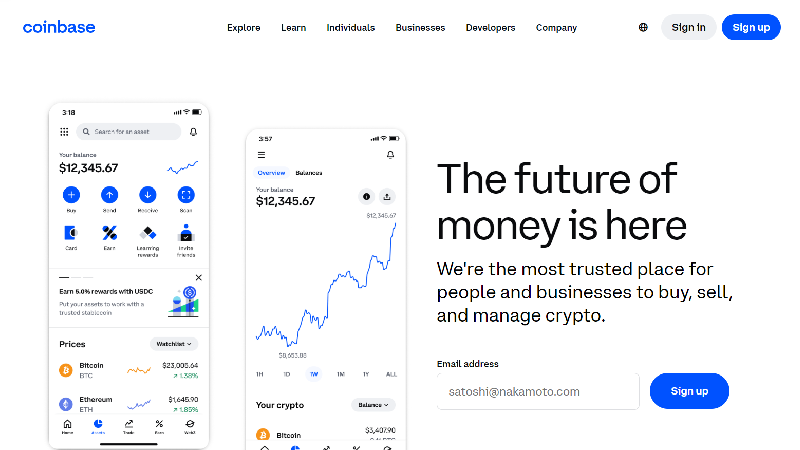

Coinbase

Coinbase is a U.S. cryptocurrency exchange that has a user-friendly platform for buying, selling, and trading over 100 cryptocurrencies. Coinbase is one of the largest and most well-known cryptocurrency exchanges in the world, with over 73 million users in over 100 countries.

Fees: Variable fees (Coinbase), 0%-0.60% (Coinbase Advanced Trade)

Pros

- User-friendly platform

- Wide range of cryptocurrencies

- Secure and reliable

- Good customer support

Cons

- Higher fees than some competitors

- Limited trading options

- Not available in all countries

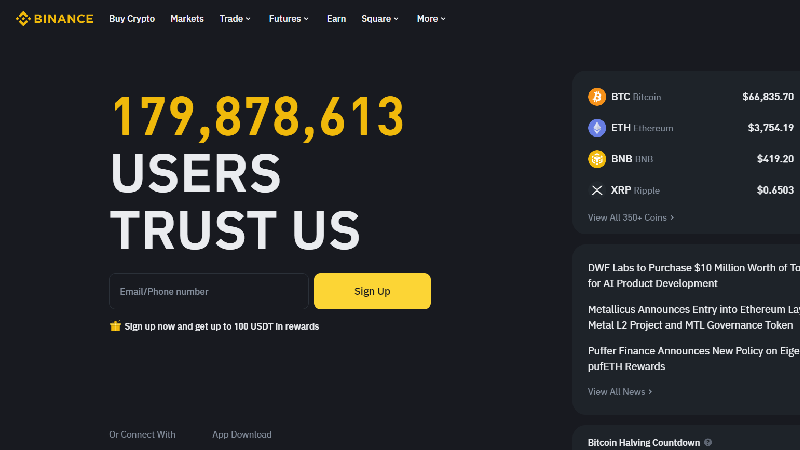

Binance

Binance is a global cryptocurrency exchange offering various trading pairs for over 350 cryptocurrencies. Binance is one of the largest and most popular cryptocurrency exchanges in the world, with over 120 million users in over 180 countries.

Fees: Variable fees (Binance), 0.01%-0.10% (Binance Pro)

Pros

- Wide range of cryptocurrencies

- Low fees

- Advanced trading features

Cons

- Complex platform for beginners

- Not available in all countries

- Some regulatory scrutiny

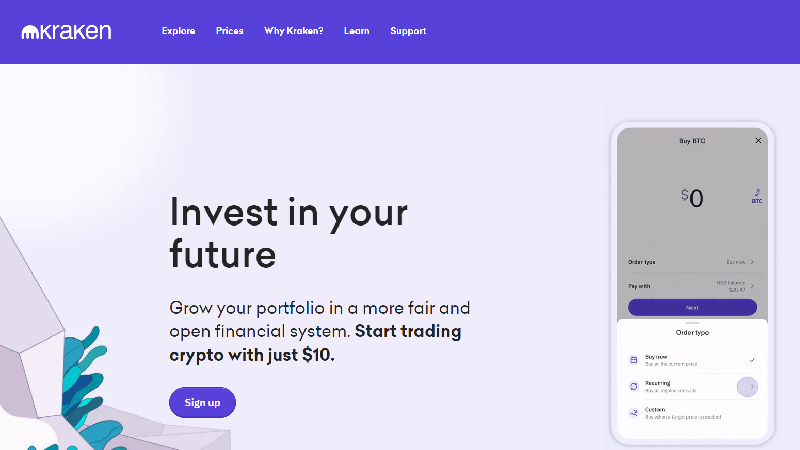

Kraken

Kraken also works globally has trading pairs for over 160 cryptocurrencies. It is a well-established exchange with a strong reputation for security and reliability, and it is a popular choice for traders who are looking for a sophisticated trading platform.

Fees: Variable fees (Kraken), 0.16%-0.26% (Kraken Pro)

Pros

- Wide range of cryptocurrencies

- Low fees for high-volume traders

- Secure and reliable

- Advanced trading features

Cons

- Complex platform for beginners

- Not available in all countries

- Customer support can be slow

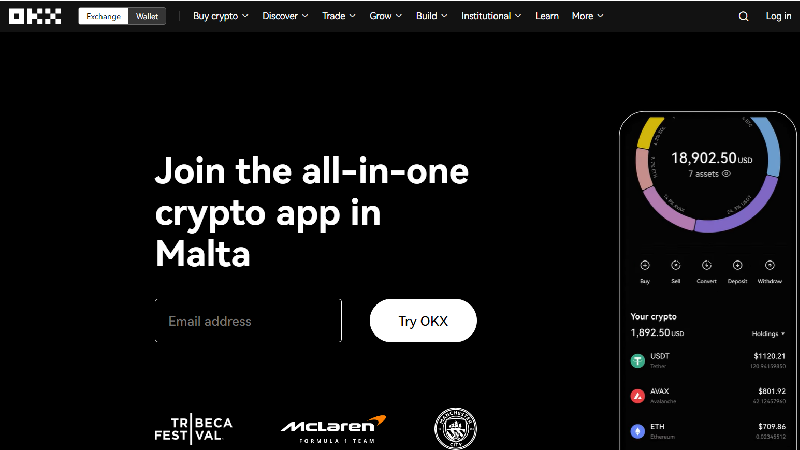

OKX

OKX is one of the best cryptocurrency exchanges with trading pairs for over 500 cryptocurrencies. It is large and very popular platform, with over 20 million users in over 160 countries.

Fees: Variable fees (OKEx), 0.10%-0.02% (Pro)

Pros

- Wide range of cryptocurrencies

- Low fees

- Advanced trading features

- Margin trading

- Futures trading

- Staking and lending

- NFT platform

Cons

- Complex platform for beginners

- Not available in all countries

- Some regulatory scrutiny

KuCoin

KuCoin offers trading pairs for over 700 cryptocurrencies. It is one of the largest cryptocurrency exchanges in the world, with over 18 million users in over 200 countries.

Fees: Variable fees (KuCoin)

Pros

- Low fees

- Wide range of cryptocurrencies

- Advanced trading features

- Margin trading

- Futures trading

- Staking and lending

Cons

- Not available in all countries

- Some regulatory scrutiny

eToro

eToro is a leading global multi-asset trading platform offering a wide range of products and services, including stocks, ETFs, forex, commodities, indices, cryptocurrencies, and more.

Fees: Variable fees (eToro), 0%-0.75% (Cryptoasset spread)

Pros

- Social investing (CopyTrader feature)

- User-friendly platform

- Wide range of products and services

Cons

- Fees for some transactions (withdrawals, currency conversions)

- Minimum deposit requirement of $50

- Margin trading is not available for all users

Gemini

Gemini has a user-friendly platform for buying, selling, and trading over 70 cryptocurrencies. It is one of the most secure and reliable cryptocurrency exchanges, with a strong focus on compliance and security.

Fees: Variable fees (Gemini), 0.50%-4.50% (Gemini ActiveTrader)

Pros

- User-friendly platform

- Wide range of cryptocurrencies

- Secure and reliable

- Advanced trading features

- Margin trading

Cons

- Higher fees than some competitors

- Limited trading options

- Not available in all countries

Fidelity Crypto

Fidelity Crypto is a cryptocurrency platform by Fidelity Investments, a well-established and respected financial services company. It offers a simple and user-friendly platform for buying and selling cryptocurrencies, and it is a good choice for beginners.

Fees: 0.95% (Fidelity Crypto), 0.1% (Fidelity ActiveTrader)

Pros

- Simple and user-friendly platform

- Wide range of cryptocurrencies

- Secure and reliable

- Low fees

- Trusted brand

Cons

- Limited trading options

- Not available in all countries

- Not as advanced as some other exchanges

Gate.io

Gate.io provides a wide range of trading pairs for over 1,300 cryptocurrencies. It is one of the largest and best cryptocurrency exchanges, with over 10 million users in over 200 countries.

Fees: Variable fees (Gate.io), 0.2%-0.02% (Margin Trading)

Pros

- Wide range of cryptocurrencies

- Low fees

- Advanced trading features

- Staking and lending

- Margin trading

Cons

- Complex platform for beginners

- Not available in all countries

- Some regulatory scrutiny

How We Rate Crypto Exchanges

In this section, we provide the aspects we pay attention to when choosing the best cryptocurrency exchanges:

Trading Capabilities

Fundamental trading capabilities involve looking at the platform’s financial health, security measures, liquidity, and regulatory compliance. Knowing these basics helps traders make smart choices, ensuring a safe and efficient trading environment.

Additionally, factors like transaction speeds, fees, and customer support quality help identify the best cryptocurrency exchanges that are reliable and transparent.

Advanced Trading

Good trading platforms offer tools that help traders work smarter. These tools include different types of trading orders, ways to manage risk, support for automated trading, and live market data. Being able to use these tools quickly and well can set the best platforms apart.

Traders can do better with platforms that have features like borrowing money to trade (margin trading), trading products like futures and options (derivatives), and ways to change how the platform looks (customizable interfaces).

Customer Support

Good customer support is essential when choosing a trading platform. It's important that help is easy to get and comes in different ways, like live chat, email, and phone calls. It makes sure that everyone can get help quickly and easily.

Support teams should speak many languages and understand different cultures. Additionally, staff who know a lot about technical issues, accounts, and keeping things safe can make customers feel more secure. Being ready to help at any time, day or night, is also important.

Educational Materials

When you're picking a trading platform, it's great to have one with easy-to-use learning tools. Look for short lessons, live classes, and clear guides that help you understand trading better so you can make good choices. The best cryptocurrency exchanges also offer tips on the market and tools to analyse trades.

Security and Storage

When choosing the best cryptocurrency exchanges, safety and storage are very important. Good security steps, like two-factor login, coded messages, and keeping cryptocurrency offline, protect users from theft and unwanted entry. Regular safety checks and meeting set standards make a platform strong, too.

Staking Rewards

A good staking rewards program can make a cryptocurrency exchange stand out – the more you can earn from staking, the better. This can depend on how long you stake your crypto and what kinds of tokens you can stake.

There are a lot of benefits of staking crypto, so top exchanges work hard to create staking rewards that people will like. They keep up with what's popular and what users want. By offering great staking deals, exchanges can keep their users happy.

Crypto Lending

The best crypto exchanges offer easy-to-use lending services with good interest rates. They have different ways to lend and keep the process safe. For instance, some platforms offer user-friendly interfaces where you can lend out your cryptocurrency at competitive rates, often with the option to choose between fixed and flexible terms.

Crypto Exchange Guide

In this part, we provide a detailed explanation on what crypto exchanges are and how they work.

What is Crypto Exchange?

A crypto exchange is an online platform where users can buy, sell, or trade cryptocurrencies. It acts as a marketplace for crypto assets, helping buyers and sellers complete transactions. Crypto exchanges handle order matching, price discovery, and liquidity, allowing users to swap one cryptocurrency for another or exchange crypto for fiat currency.

Crypto exchanges fall into two main types: centralized exchanges (CEX) and decentralized exchanges (DEX). Each type has its own features and benefits. Users usually create accounts, deposit funds, and start trading, which keeps the cryptocurrency market active and dynamic.

How do Cryptocurrency Exchanges Work?

- Users deposit fiat currency or other cryptocurrencies into their exchange wallets.

- Users choose the cryptocurrency pairs they want to trade.

- They place buy or sell orders specifying the quantity and price.

- The exchange matches buy and sell orders based on price and executes trades.

- The completion of a user's trade happens when their order is matched with others in the market, resulting in the buying or selling of the asset at the agreed-upon price.

- User wallets are updated to reflect the new cryptocurrency balances.

- Users can withdraw funds by converting cryptocurrencies to fiat or transferring to external wallets.

- Traders analyze market data, charts, and trends for informed decision-making.

- Exchanges implement security protocols like encryption and two-factor authentication.

- Following local regulations and compliance standards is essential for the exchange's operation.

- Exchanges charge fees for transactions, withdrawals, and other services.

- Higher liquidity attracts more traders, reducing the impact of large transactions on market prices.

- Cryptocurrencies are kept in secure wallets, often using cold storage to ensure extra safety.

- Some users integrate trading bots or other applications via the exchange's API for automated trading.

Types of Cryptocurrency Exchanges

Centralized (CEX)

Centralized Exchanges (CEX) are traditional platforms where users trade cryptocurrencies through an intermediary. Exchanges such as Binance and Coinbase provide high liquidity, ease of use, and centralized management of transactions. However, users must trust the exchange to securely handle their funds.

Decentralized (DEX)

Decentralized Exchanges (DEX) are platforms where users trade cryptocurrencies directly without a central authority. Using blockchain technology, DEXs like Uniswap and SushiSwap provide greater privacy, security, and control over funds. There are even more well-rated decentralized exchanges to check.

Cryptocurrency Exchange Fees

Fees are charged when you buy or sell cryptocurrencies. They are typically a percentage of the transaction amount. The exact fee structure varies from exchange to exchange, but usually users prefer platforms that offer the most competitive rates, or low-fee crypto exchanges.

Trading Fees

The exact trading fee structure varies from exchange to exchange, but some common examples include:

- Maker fees are charged to traders who place limit orders, which are used to buy or sell a cryptocurrency at a specific price or better. These fees are usually lower than taker fees because they help add liquidity to the market.

- Taker fees are charged to traders who place market orders, which are filled instantly at the best available price. These fees are generally higher than maker fees because they remove liquidity from the market.

- Some exchanges offer tiered fees, which means that the fees you pay will depend on the amount of cryptocurrency you trade. Higher-volume traders will typically pay lower fees than lower-volume traders.

Deposit and Withdrawal Fees

Deposit and withdrawal fees are charged when you move funds into or out of your exchange account. The exact fee structure will vary from exchange to exchange, but some common examples include:

- Some exchanges offer free deposits for certain fiat currencies or cryptocurrencies.

- Others charge a flat fee for withdrawals, regardless of the amount of cryptocurrency being withdrawn.

- Some exchanges charge a percentage fee for withdrawals, which is a percentage of the amount of cryptocurrency being withdrawn.

Listing Fees

Listing fees are charged to cryptocurrency projects that want to be listed on an exchange. The fee structure will vary from exchange to exchange, but it will typically include a flat fee and a percentage of the project's market capitalization.

Fiat-to-crypto Conversion Fees

Fiat-to-crypto conversion fees are charged when you convert fiat currency (like US dollars or euros) into cryptocurrency. The exact fee structure will vary from exchange to exchange, but it will typically be a percentage of the amount being converted.

Subscription Fees

Subscription fees are charged to users who want to access premium features on an exchange. These features may include:

Margin trading that allows you to borrow funds from the exchange to trade with.

Futures trading allows you to buy or sell cryptocurrency contracts that will expire at a certain time in the future.

Crypto-backed loans let you use your cryptocurrency as collateral to borrow funds.

Other Fees

Other fees may include:

Some exchanges charge inactivity fees if you don't trade or deposit funds into your account for a certain period of time.

Others charge security fees to cover the costs of their security measures.

Some may charge premium support fees for users who want faster or more personalized customer support.

Cryptocurrency Exchange vs Cryptocurrency Wallet

Cryptocurrency Exchange

A cryptocurrency exchange is a platform where you can buy, sell, and trade cryptocurrencies. In general, there are basic features at cryptocurrency exchanges:

- Users can place orders to buy or sell cryptocurrencies at a specified price or better.

- Exchanges provide real-time market data on the prices of cryptocurrencies.

- Users can convert fiat currency (like US dollars or euros) into cryptocurrency and vice versa.

- They can borrow funds from the exchange to trade with.

- Users can buy or sell cryptocurrency contracts that will expire at a certain time in the future.

- They can use their cryptocurrency as collateral to borrow funds.

Cryptocurrency Wallets

A cryptocurrency wallet is a software or hardware device that stores your cryptocurrency. It's always useful to understand the differences between hardware and software options:

Hardware Cryptocurrency Wallets

- Hardware wallets secure your cryptocurrency private keys, which are the passwords that allow you to access your funds.

- Users can send and receive cryptocurrencies from their wallet.

- This type of wallet provide a history of your cryptocurrency transactions.

- Hardware wallets can support multiple cryptocurrencies.

- They can be stored offline, which helps protect your cryptocurrency from online attacks.

Software Cryptocurrency Wallets

- Software wallets securely store your private keys on your device.

- Users can easily send and receive cryptocurrencies from their wallet.

- Software wallets offer a detailed history of your cryptocurrency transactions.

- Many software wallets support a wide range of cryptocurrencies.

- This type of wallets allow you to access your funds from any internet-connected device.

- Some software wallets can be linked to exchanges for easy trading.

- These wallets often have intuitive interfaces for managing your assets.

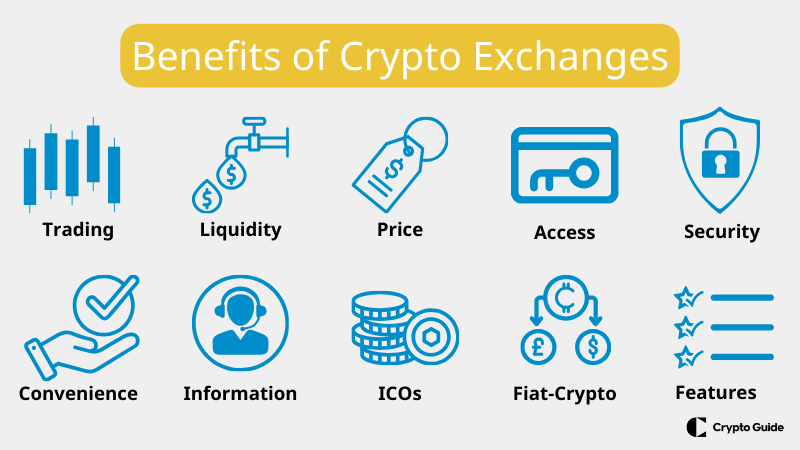

Crypto Exchange Benefits

- Crypto exchanges offer a platform for buying, selling, and trading various cryptocurrencies, helping users take advantage of market opportunities.

- They improve market liquidity by connecting buyers and sellers, ensuring there is a market for different digital assets.

- Exchanges help determine cryptocurrency prices as market participants establish value through supply and demand.

- Users can access various cryptocurrencies, allowing them to diversify their portfolios.

- Reputable exchanges use strong security measures to safeguard user funds and personal information.

- With online access and easy-to-use interfaces, trading is convenient for people around the world.

- Crypto exchanges provide real-time market data, charts, and other information to support informed decision-making.

- They often facilitate fundraising for new projects through ICOs and list new tokens, offering investment opportunities.

- Some exchanges allow users to convert traditional fiat currencies into cryptocurrencies, making it easier for newcomers to enter the market.

- Many cryptocurrency exchange platforms also offer advanced trading features like margin trading, futures contracts, and options for experienced traders.

Cryptocurrency Exchange Challenges

- Cryptocurrency exchanges can be hacked or experience security breaches, putting user funds at risk. There have been serious incidents causing major financial losses for users and exchanges alike.

- Regulations for crypto exchanges are constantly changing and can be unclear. This creates challenges for exchanges as they work to stay compliant in different regions.

- Some cryptocurrencies may have low liquidity on exchanges, leading to price swings and difficulties in executing trades at the desired prices.

- Without strict regulations, crypto exchange platforms are vulnerable to market manipulation, such as pump-and-dump schemes and other fraudulent practices.

- Technical issues, server outages, and downtime can disrupt trading and reduce trust in the exchange's reliability.

Final Thoughts on the Best Cryptocurrency Exchanges 2026

The best cryptocurrency exchanges offer many benefits, like the chance to trade, lots of liquidity, and a big selection of cryptocurrencies. But they also have some challenges, such as keeping things secure, dealing with unclear rules, and managing risks in their operations.

As the crypto market keeps changing, exchanges need to work on making things more secure, following the rules, and helping users better. Doing these things will help people trust them more which is important for crypto to keep growing and become a normal part of finance.